|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Exploring Mortgage Interest Rates Near Me: A Comprehensive GuideUnderstanding Mortgage Interest RatesMortgage interest rates play a crucial role in determining the cost of your home loan. They influence your monthly payments and the total amount paid over the life of the loan. Understanding these rates is essential when considering a mortgage. What Are Mortgage Interest Rates?Mortgage interest rates are the percentage charged on the principal amount of a mortgage loan. They can be fixed or variable, affecting how much you pay over time. Fixed rates remain constant, while variable rates can change based on market conditions. Factors Influencing Mortgage Rates

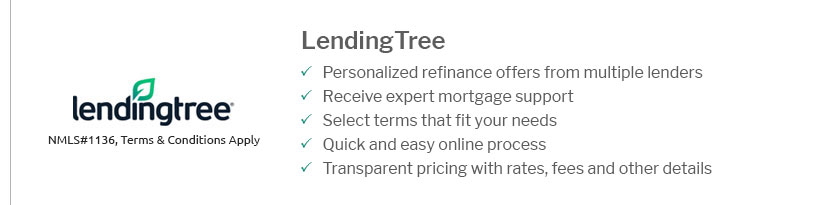

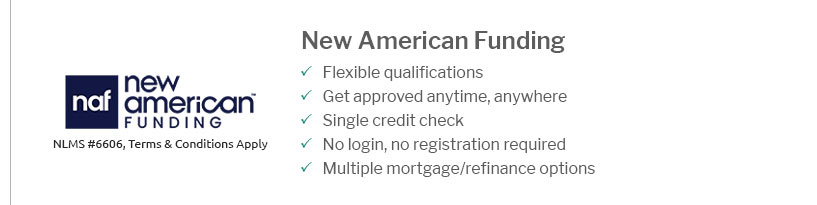

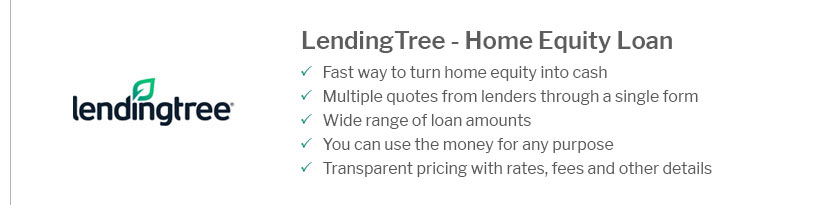

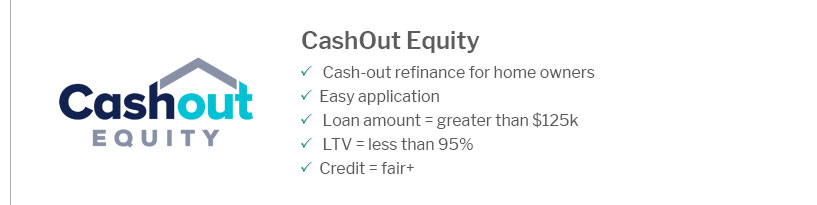

Where to Find the Best Mortgage Rates Near MeFinding the best mortgage rates requires research and comparison. Local banks, credit unions, and online lenders are good places to start. Local Banks and Credit UnionsThese institutions often offer competitive rates and personalized service, making them a viable option for many borrowers. Online LendersOnline lenders provide convenience and often lower rates. They offer a variety of loan options, including the best joint loan rates, which can be beneficial for couples looking to buy a home together. FAQ

https://www.sfcu.org/personal/mortgages/mortgage-rates/

Visit a Branch. ATM & Branch Locator - 888.723.7328 ... https://www.realtor.com/mortgage/rates/San-Mateo_CA

View current San Mateo, CA mortgage rates from multiple lenders at realtor.com. Compare the latest rates, loans, payments and fees for ARM and fixed-rate ...

|

|---|